Embarking on the journey with your new Credit Karma Visa Debit Card begins with activation—a vital step to unlocking its full potential. Whether you’re tech-savvy or prefer straightforward solutions, this guide caters to every user.

Let’s walk through the activation process on various devices, ensuring you can start managing your finances with ease.

How To Credit Karma.Com/Activate

Activate your Credit Karma Visa Debit Card swiftly with our comprehensive guide. Follow our step-by-step instructions on Credit Karma.Com/Activate to start using your card today.

Read Also:

Online Activation

Activating your Credit Karma Visa Debit Card online is simple and secure.

Step 1: Visit the Activation Website

Navigate to Credit Karma.Com/Activate using your preferred web browser on a desktop or laptop.

This page is designed specifically for the activation process, offering a user-friendly interface.

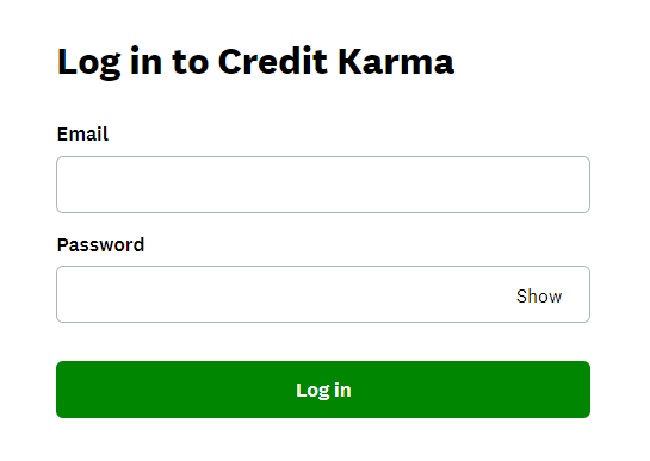

Step 2: Log into Your Account

If you’re already a Credit Karma user, log in with your credentials.

New users will need to create an account. Click on “Sign up” and follow the prompts to register.

Step 3: Enter Your Card Details

Once logged in, you’ll find an activation section where you’re prompted to enter your card information.

This includes your card number, expiration date, and the CVV code found on the back of the card.

Step 4: Verify Your Identity

For security purposes, you may need to answer additional verification questions or provide personal information.

Step 5: Confirm Activation

After entering all necessary details, submit your information.

You’ll receive a confirmation message indicating that your card is now active.

Mobile App Activation

The Credit Karma mobile app offers an alternative method to activate your card.

Step 1: Download and Open the App

Find the Credit Karma app in the Apple App Store or Google Play Store.

Download and install it on your mobile device.

Step 2: Sign In or Sign Up

Open the app and log in to your Credit Karma account.

New users will need to tap on the sign-up option and create an account.

Step 3: Navigate to Activation

In the app, locate the card activation option. This may be under a menu or prominently displayed on the home screen.

Step 4: Input Card Information

Enter your Credit Karma Visa Debit Card details as prompted.

Step 5: Complete Verification

Follow any additional steps required by the app to verify your identity.

Step 6: Activate Your Card

Once all information is entered, confirm to activate your card.

A notification within the app will confirm that your card is ready for use.

Customer Support Activation

For those who prefer personal assistance or are experiencing difficulties, Credit Karma’s customer support is available.

Step 1: Prepare Your Information

Have your card and personal identification information ready before calling.

Step 2: Call Customer Support

Dial the customer service number provided by Credit Karma or listed on the back of your card.

Step 3: Provide Necessary Details

Follow the instructions given by the customer service representative.

You’ll need to give them your card details and answer verification questions.

Step 4: Confirm Over the Phone

The representative will guide you through the process and confirm once your card is activated.

Activation Benefits

Activating your Credit Karma Visa Debit Card is not just a step towards using a new payment method; it’s about unlocking a suite of benefits designed for your financial empowerment and convenience.

Here’s a detailed look at the benefits you’ll enjoy upon activation and the plans available.

Zero Fees:

Enjoy a debit card experience without the worry of hidden charges, including no annual fees and no fees for minimum balance requirements.

Credit Building:

If you’re looking to improve your Credit score, regular use of your Credit Karma Visa Debit Card can be beneficial. While a debit card itself doesn’t directly affect your Credit rating, the financial habits you develop and the ability to monitor your Credit through Credit Karma can support your Credit-building journey.

Real-Time Transaction Alerts:

Stay informed with immediate alerts for every transaction, which can help you quickly detect any unauthorized activity and manage your spending better.

Visa’s Zero Liability Protection:

Shop with confidence knowing you’re protected by Visa’s Zero Liability Policy, ensuring you won’t be held responsible for unauthorized charges on your card.

Free Withdrawals:

Gain access to free ATM withdrawals within an extensive network, saving you from the expense of withdrawal fees.

Easy Deposit Options:

Enjoy the ease of depositing checks through the mobile app, direct deposit, or through bank transfers.

Instant Block Feature:

If your card is lost or stolen, you can instantly block new purchases using the Credit Karma app.

Activation Plans

Credit Karma offers a singular, straightforward plan for its Visa Debit Card users. Unlike Credit card companies that offer various tiers with differing interest rates and reward systems, Credit Karma keeps it simple. Here are some highlights:

No Monthly Charges:

Credit Karma doesn’t impose any monthly or annual service charges for card maintenance.

Accessible Account Monitoring:

The Credit Karma app is a hub for all your financial monitoring needs. You can check your balance, review transactions, and manage your card without needing different services.

Direct Deposit Advantages:

Users who set up a direct deposit can often receive their funds earlier than the traditional banking system.

Seamless Integration:

The Credit Karma Visa Debit Card integrates with your Credit Karma Money account, making it easy to keep track of your savings and checking accounts in one place.

Read Also:

Conclusion

Whichever method you choose, activating your Credit Karma Visa Debit Card is a straightforward process. With your card activated, you can immediately begin using it for your financial transactions and take advantage of Credit Karma’s features designed to help you manage your money more effectively.